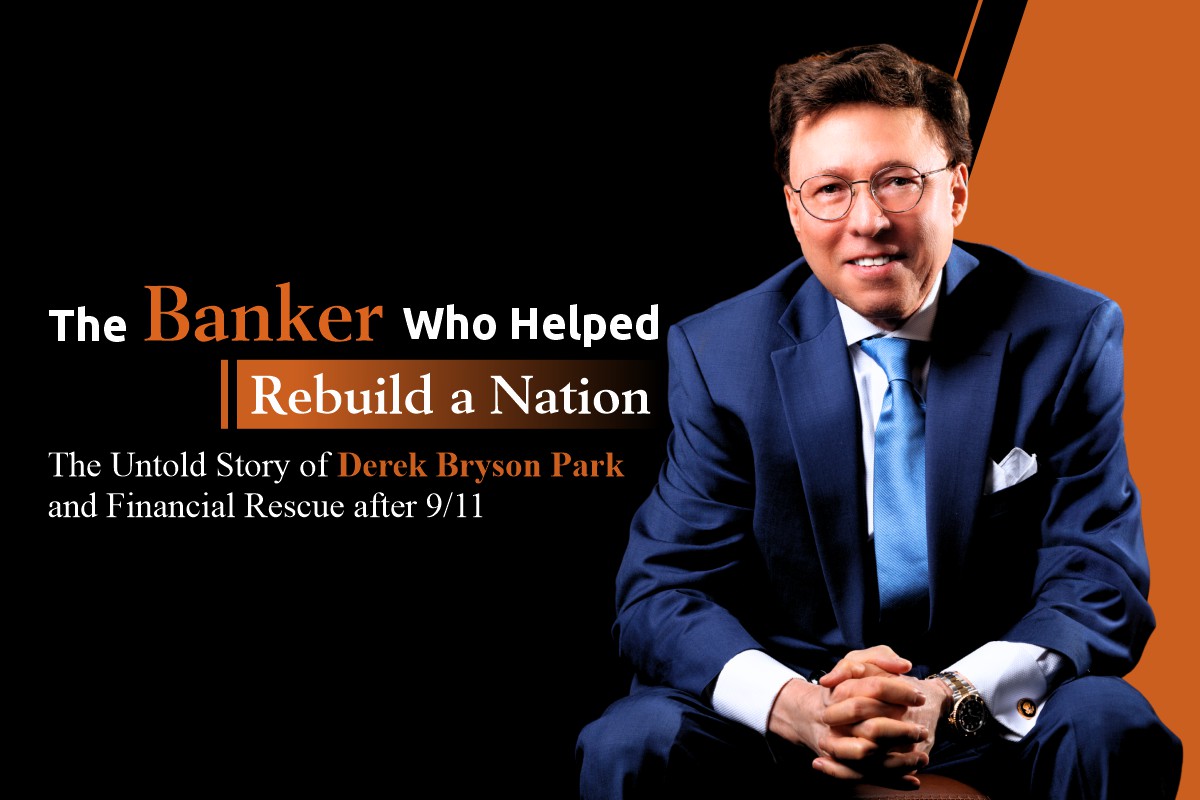

The Banker Who Helped Rebuild a Nation

The Untold Story of Derek Bryson Park and Financial Rescue after 9/11

When cities fall, it takes more than bricks and bulldozers to rebuild them. It takes someone who understands the markets, the people, and the invisible architecture of finance that keeps economies breathing. In the aftermath of September 11, 2001, while America mourned and Wall Street staggered, one man worked behind the scenes to stabilize the housing system, inject liquidity, and quietly shape a recovery few understood in the moment. His name was Derek Bryson Park, and this is the story of his role as a central banker—an unsung but vital force in one of America’s most turbulent times.

Before the rubble had even settled, Derek had already stepped into a role that would define not only his career in public service but a turning point in American housing finance.

Presidential Confidence across Party Lines

In 1999, President Bill Clinton appointed Derek as Director of the Federal Home Loan Bank of New York (FHLBNY). His nomination wasn’t a routine political placement but a strategic decision that drew the backing of both Senate Majority Leader Trent Lott (R) and Senator Chris Dodd (D). When President George W. Bush later extended Derek’s appointment, it became evident that this was more than political optics, it was a recognition of his singular ability to comprehend both the technical and human aspects of housing finance.

Just months into his role, Derek made history. He became the first White House appointee ever nominated to the Executive Committee of the FHLB System, a move that required an amendment to the Bank’s charter. This milestone cemented his role as a central banker of unusual reach and responsibility—one who wasn’t managing policy from afar, but directly shaping the strategic course of the bank from within.

This wasn’t merely about financial mechanics. Derek’s leadership came at a time of deep economic uncertainty. With rising housing needs and looming market instability, his mission was to secure liquidity, stabilize institutions, and expand access to affordable housing across an economically diverse district—New York, New Jersey, Puerto Rico, and the U.S. Virgin Islands.

Derek’s appointment and eventual elevation into the executive ranks of the FHLBNY reflected a rare bipartisan alignment around the importance of housing finance. The stakes were high. As the Bank approached its 70th anniversary in 2002, its relevance had never been greater. The events of September 11, 2001, would soon underscore just how vital the Bank and Derek’s leadership would be.

What Is a Central Banker, Really?

Most imagine central bankers as technocrats moving interest rates behind mahogany doors. However, in Derek’s case, his role was far more immediate. As a Director and Central Banker, he became a first responder for financial institutions, helping them maintain stability and liquidity when traditional markets faltered.

His mission at the FHLBNY was clear, keep the engine of housing finance running—even under duress. The Bank, while not consumer-facing, was a powerful source of liquidity for member institutions—credit unions, community banks, and insurance companies. Derek understood this ecosystem, and under his direction, the Bank delivered capital where it was needed most.

September 11: Crisis, Response, and Recovery

When the World Trade Center collapsed, it sent shockwaves through the financial district and the national economy. Yet the Bank didn’t waver. Under Derek’s guidance, the FHLBNY responded swiftly by approving $4.7 billion in emergency advances to its member institutions. These weren’t just numbers on a spreadsheet, they represented the economic survival of millions of families, small businesses, and neighborhoods devastated by the attack.

Even more, the Bank facilitated Capital Plan Approvals essential for rebuilding the city, financing critical redevelopment projects including the construction of the new World Trade Center and its surrounding infrastructure. It worked in close partnership with private developers and federal agencies, ensuring that funding pipelines didn’t stall when the city needed them most.

This work defined Derek’s legacy as a central banker, not just a steward of financial tools, but a builder of systems resilient enough to heal cities.

Liquidity, Housing, and a $1.18 Trillion Balance Sheet

The numbers tell a compelling story. In 1999, the FHLBNY reported $33.3 billion in advances. By 2001, that figure reached $39.5 billion. After 9/11, the Bank’s support surged, not only in direct advances but also in targeted programs designed to help rebuild communities.

In 2002, the Bank’s Affordable Housing Program (AHP) issued approximately $30 million in grants to support the creation and rehabilitation of housing units. These funds were especially critical in New York and nearby regions facing a post-attack housing crunch.

The Bank also broadened its community investment programs, supporting infrastructure revitalization and local economic development efforts. From financing roads and utilities to underwriting neighborhood restoration projects, the Bank’s initiatives, driven by Derek’s strategy—kept economic engines running when confidence had all but vanished.

By the end of his tenure, the Federal Home Loan Bank System had the largest balance sheet in the United States—$1.18 trillion, compared to the Federal Reserve’s $870 billion at the time.

A Region like No Other, A Bank like No Other

The FHLBNY stands apart within the 11-member Bank System. Its territory includes economic powerhouses like New York City and New Jersey, as well as the complex island economies of Puerto Rico and the U.S. Virgin Islands. Derek’s leadership brought flexibility to this diverse network, ensuring that the Bank’s services were tailored, region-specific, and deeply embedded in the unique challenges of each community it served.

Whether supporting redevelopment in Lower Manhattan or ensuring liquidity for financial institutions in the Caribbean, Derek’s motive was about impact—not headlines.

Legacy in Motion

In 2002, as the Federal Home Loan Bank System celebrated its 70th anniversary, it did so under the steady leadership of individuals like Derek Bryson Park—whose foresight and decisiveness helped shape a stronger, more resilient housing finance terrain.

Today, he continues his work out of the spotlight. As Principal at Wilmington Capital, in partnership with the Royal Bank of Canada, he manages a broad suite of individual accounts, trusts, and foundations. But compliance rules dictate discretion; his responsibilities, while expansive, are summarized in a single concise paragraph available online. And perhaps that’s fitting.

For a man who helped rebuild a city without asking for credit, who reshaped housing finance from the inside out, and who proved that a central banker’s true power lies not in authority, but in action—the impact continues to resonate.

Powerfully.